Private Profits Summit

October 24, 2019 - 1 P.M. (ET)

October 24, 2019 - 1 P.M. (ET)

October 20th, 2019

In today’s update, I’m going to discuss how to buy shares through these deals.

When you buy shares of a company through a private placement deal, you’re buying shares of stock that are NOT available to the general public.

So how exactly does it work?

It’s different than buying shares of companies trading on regular exchanges.

For example, say you want to buy shares of a big, publicly traded company like Disney...

You’d log on to your online brokerage account, find the ticker, put in a buy order, and hope a seller accepts your price.

For private placement investing, all of that goes out the window.

That’s because you will not be buying any of these investments online.

In fact, you’ll need to fill out paperwork, sign agreements, and either execute a wire transfer or actually write out a check and send it into the company.

Remember, you’re not buying shares on an exchange the way you usually would.

You’re buying shares from the actual company.

Once you’ve signed the papers and sent in your check to the company, you will receive a stock certificate in the mail.

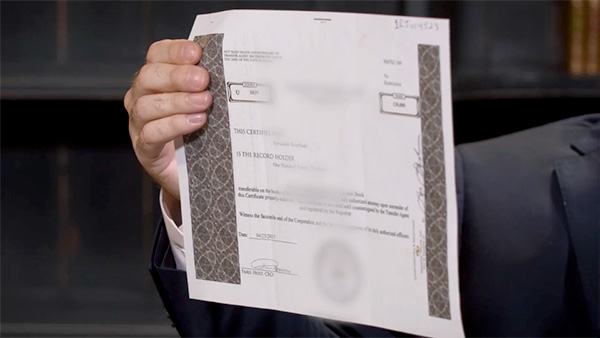

The stock certificate looks something like this:

If you’re used to buying stocks through online brokerages like E-Trade or Ameritrade, then these certificates are something you rarely see these days.

But when you buy shares of a company through a private placement deal, you will receive the company’s stock certificate in the mail, and along with it, some paperwork you’ll need to submit to a live broker.

Sometimes the company will recommend a broker to use for this step. But sometimes it won’t.

So it’s good to have a broker you can reach out to just in case.

That live broker will then deposit the shares, as specified in that certificate, into your account.

In short, this process takes slightly more work than buying traditional stocks.

But here’s the thing...

Private placements can generate returns that make traditional stock returns look like table scraps.

And it’s the reason the rich have used this market to get richer for centuries...

A market that mainstream investors don’t even know exists.

These deals are usually made on private golf courses... on private jets... in reserve boxes at sporting events... in top-floor meeting rooms at five-star hotels.

I hate velvet ropes. It’s just not fair to Main Street investors.

But that’s why I’m pulling back the curtain...

You can finally get access to the same kind of investment that early investors in Facebook had, generating returns of 287,000%.

And the same kind of investment Tesla’s earliest investors had, which generated a return of 863,900%.

Only private placements can deliver returns like this...

So why shouldn’t you get a piece of the action?

In our next training module, I’ll discuss the process for selling your shares from these deals.

Sincerely,

![]()

Alex Koyfman

Founder, Private Profits Summit